🐊

🤖

COINGATOR: a statistical rusty searcher

👾

✨

(need to commit the rest of this work: i will add everything when i am back from vacation)

tl; dr

🐊

this program implements a searcher running statistical strategies on several exchanges. It's called coingator because it's a cute animal that rhymes with cointegratoooor.

📚

for more details about this project, check my mirror post: bot #3: coingator, a rusty cointegratooor searcher.

🚨

disclaimer: this project is a boilerplate to get you started; you might or might not profit from it: in the mev world, nobody is going to handle you the alpha. i am not responsible for anything you do with my free code.

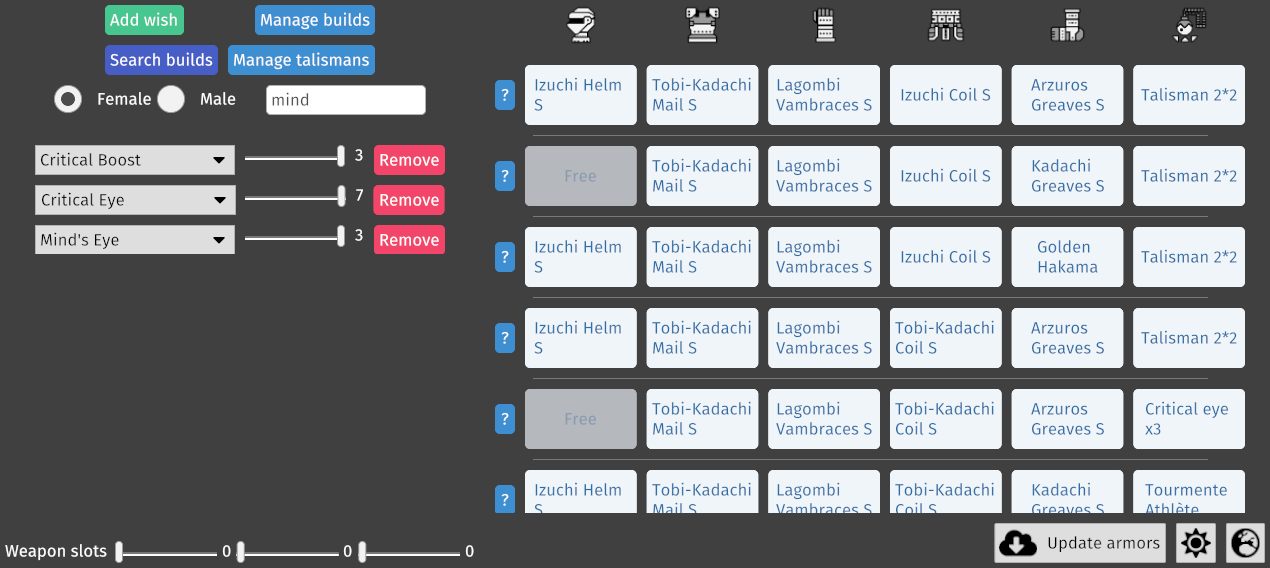

strategies

One of the most well-known strategies among different algorithmic trading methods is the statistical arbitrage strategy: a profitable situation stemming from pricing inefficiencies among financial markets. Statistical arbitrage is a mere strategy to obtain profit by applying past statistics.

cointegration

- cointegration is the test correlation between two or more non-stationary time series for a specified period (identifying long-run parameters and determining when stationary time series do not depart from equilibrium).

Formally, if (X,Y,Z) are each integrated of order d, and there exist coefficients a, b, c such that aX + bY + cZ is integrated of the order less than d, then X, Y, and Z are cointegrated.

- in this tool, we implement this strategy with the following steps:

1. retrieve a list of tradeable symbols

2. generate price history

3. identify cointegrated pairs

4. identify trends

5. backtest

monitoring

with bybit

- using this code, we use websockets and bybit's API to monitor the following:

* spot pair orderbook, depth, k-lines, and private execution reports

* inverse public orderbooks, trades, insurances, perpetuals, futures, liquidations

* inverse private positions, executions, stop orders

- to create a trading bot, you can select: pair, price range, number of grids, and total investment.

local set up

Make sure you have rust installed and add info to a .env file:

cp .env.example .env

vim .env

Then install COINGATOR with:

make build

Run with:

make run

running with bybit

bybit REST endpoints:

- Testnet: https://api-testnet.bybit.com

- Mainnet: https://api.bybit.com, https://api.bytick.com

subscribing to topics on a derivative

Crypto derivatives are financial contracts that derive their values from underlying assets. Crypto futures contracts are proxy tools to speculate on the future prices of cryptocurrencies or to be used to hedge against their price changes.

Select 1:

🐊 welcome to coingator 🪙. type your option:

➡ 1: sub to public topics for a derivative (e.g., ETHUSDT)

This will open a websocket with bybit and subscribe to the following derivative's topics:

- depths

- trades

- book tickers

- realtimes

Example output:

🐊 subscribing to websockets for: "ETHUSDT"

✅ depth: ResponseV2 { topic: "depth", params: ResCommonParamsV2 { binary: "false", symbol: "ETHUSDT", symbol_name: "ETHUSDT" }, data: Depth { t: 1672627313579, s: "ETHUSDT", v: "1672627313579_1", b: [OrderBookItem("1196.53", "6.81229"), OrderBookItem("1196.52", "10"), OrderBookItem("1196.51", "0.08357"), OrderBookItem("1196.46", "0.01876"), OrderBookItem("1196.44", "0.16778"), OrderBookItem("1196.4", "10.00414"), OrderBookItem("1196.39", "3.62"), OrderBookItem("1196.33", "11.98536"), OrderBookItem("1196.32", "4.37768"), OrderBookItem("1196.31", "0.25238"), OrderBookItem("1196.3", "2.44169"), OrderBookItem("1196.28", "6.48"), OrderBookItem("1196.27", "3.46"), OrderBookItem("1196.24", "0.001"), OrderBookItem("1196.22", "1.52901"), OrderBookItem("1196.21", "3.14679"), OrderBookItem("1196.19", "1.54244"), OrderBookItem("1196.18", "1.24823"), OrderBookItem("1196.16", "6.75"), OrderBookItem("1196.15", "4.35209"), OrderBookItem("1196.14", "0.30445"), OrderBookItem("1196.13", "0.41108"), OrderBookItem("1196.06", "16.713"), OrderBookItem("1196.04", "5"), OrderBookItem("1196.01", "9.5338"), OrderBookItem("1196", "4.009"), OrderBookItem("1195.99", "1.7134"), OrderBookItem("1195.97", "1.2251"), OrderBookItem("1195.95", "26.34158"), OrderBookItem("1195.91", "5"), OrderBookItem("1195.9", "0.08359"), OrderBookItem("1195.85", "0.89955"), OrderBookItem("1195.83", "0.16989"), OrderBookItem("1195.82", "1.25766"), OrderBookItem("1195.8", "2.515"), OrderBookItem("1195.76", "3.57"), OrderBookItem("1195.75", "5"), OrderBookItem("1195.72", "0.1672"), OrderBookItem("1195.7", "3.78046"), OrderBookItem("1195.69", "1.41835")], a: [OrderBookItem("1196.69", "2.02591"), OrderBookItem("1196.72", "0.001"), OrderBookItem("1196.8", "0.0192"), OrderBookItem("1196.84", "0.25238"), OrderBookItem("1196.9", "3"), OrderBookItem("1196.92", "1.94"), OrderBookItem("1196.93", "0.16315"), OrderBookItem("1196.94", "0.89955"), OrderBookItem("1196.95", "2.02888"), OrderBookItem("1196.96", "4.00607"), OrderBookItem("1196.98", "3.687"), OrderBookItem("1197", "0.01624"), OrderBookItem("1197.02", "3.05537"), OrderBookItem("1197.05", "0.84081"), OrderBookItem("1197.08", "1.51308"), OrderBookItem("1197.09", "3.174"), OrderBookItem("1197.1", "0.03835"), OrderBookItem("1197.13", "1.5768"), OrderBookItem("1197.15", "24.16"), OrderBookItem("1197.18", "0.83532"), OrderBookItem("1197.2", "2.18155"), OrderBookItem("1197.22", "1.52477"), OrderBookItem("1197.23", "1.71323"), OrderBookItem("1197.27", "9.5338"), OrderBookItem("1197.29", "2.73673"), OrderBookItem("1197.32", "0.0503"), OrderBookItem("1197.35", "25.07989"), OrderBookItem("1197.42", "16.713"), OrderBookItem("1197.43", "0.03916"), OrderBookItem("1197.44", "0.83499"), OrderBookItem("1197.5", "46.17"), OrderBookItem("1197.52", "0.12796"), OrderBookItem("1197.53", "1.15349"), OrderBookItem("1197.55", "25.75042"), OrderBookItem("1197.6", "0.09146"), OrderBookItem("1197.65", "0.26999"), OrderBookItem("1197.66", "0.89955"), OrderBookItem("1197.67", "12.01463"), OrderBookItem("1197.71", "0.8725"), OrderBookItem("1197.72", "0.1")] } }

✅ trade: ResponseV2 { topic: "trade", params: ResCommonParamsV2 { binary: "false", symbol: "ETHUSDT", symbol_name: "ETHUSDT" }, data: Trade { v: "2280000000030465445", t: 1672627309524, p: "1196.69", q: "0.00083", m: true } }

✅ book ticker: ResponseV2 { topic: "bookTicker", params: ResCommonParamsV2 { binary: "false", symbol: "ETHUSDT", symbol_name: "ETHUSDT" }, data: BookTicker { symbol: "ETHUSDT", bid_price: "1196.53", bid_qty: "6.81229", ask_price: "1196.69", ask_qty: "2.02591", time: 1672627312138 } }

✅ realtimes: ResponseV2 { topic: "realtimes", params: ResCommonParamsV2 { binary: "false", symbol: "ETHUSDT", symbol_name: "ETHUSDT" }, data: Realtimes { t: 1672627309524, s: "ETHUSDT", c: "1196.69", h: "1204.66", l: "1190.96", o: "1195.91", v: "20134.37723", qv: "24113384.0565187", m: "0.0007" } }

✅ pong: Pong { pong: 1672627314329 }

(...)

subscribing to topics for a pair of crypto assets

Select 2:

🐊 welcome to coingator 🪙. type your option:

➡ 2: sub to public topics for a pair of derivatives

This will open a websocket with bybit and subscribe the pair to the following topics:

- orderbook l2 25, 200

- trades

- instruments info

- k-lines

- liquidations

Example output:

🐊 subscribing to websockets for: ["ETHUSDT", "BTCUSDT"]

✅ instrument info snapshot: Response { topic: "instrument_info.100ms.ETHUSDT", res_type: "snapshot", data: InstrumentInfoSnapshot { id: 2, symbol: "ETHUSDT", last_price_e4: "11966500", last_price: "1196.65", bid1_price_e4: "11966000", bid1_price: "1196.60", ask1_price_e4: "11966500", ask1_price: "1196.65", last_tick_direction: "ZeroPlusTick", prev_price_24h_e4: "11939000", prev_price_24h: "1193.90", price_24h_pcnt_e6: "2303", high_price_24h_e4: "12050500", high_price_24h: "1205.05", low_price_24h_e4: "11913500", low_price_24h: "1191.35", prev_price_1h_e4: "11962500", prev_price_1h: "1196.25", price_1h_pcnt_e6: "334", mark_price_e4: "11966100", mark_price: "1196.61", index_price_e4: "11965400", index_price: "1196.54", open_interest_e8: "58516141000000", total_turnover_e8: "4093197159274450000", turnover_24h_e8: "35260448999150020", total_volume_e8: "38356353516000000", volume_24h_e8: "29427055999999", funding_rate_e6: "100", predicted_funding_rate_e6: "100", cross_seq: "24972973797", created_at: "2022-03-31T03:56:16.000Z", updated_at: "2023-01-02T03:14:29.000Z", next_funding_time: "2023-01-02T08:00:00Z", count_down_hour: "5", funding_rate_interval: "8", settle_time_e9: "0", delisting_status: "0" }, cross_seq: "24972976935", timestamp_e6: "1672629272903187" }

(...)

subscribing to inverse perpetuals info

A perpetual contract has no expiration date. At Bybit, funding occurs every amount of hours, and they use the interest rate and the premium index to calculate the funding through Time-Weighted-Average-Price (TWAP) over the series of minutes rates.

To subscribe to inverse perpetuals and futures info, select 3:

🐊 welcome to coingator 🪙. type your option:

➡ 3: sub to public inverse perpetual info topics

This will open a websocket with bybit and subscribe to the following topics:

- orderbook l2 25, 200

- trades

- insurances

- instrument info

- k-lines

- liquidations

subscribing to the spot local order book

In the spot market, one can buy and sell cryptocurrencies for immediate delivery. They are directly transferred between market participants (buyers and sellers), which have direct ownership of the assets and are entitled to economic benefits, such as voting or staking participation.

Select 4:

🐊 welcome to coingator 🪙. type your option:

➡ 4: sub to spot local order book topics

This will open a websocket with bybit and subscribe to spot info on the following topics:

- trades

- diff depths

Example output:

✨🐊 ETHUSDT order book

💰 price 🛍 quantity

1217.31 1.71858

1217.29 0.9398

1217.28 3.17709

1217.25 1.71

1217.24 3.27

1217.23 5

1217.19 0.25474

1217.15 0.08218

1217.14 5.18416

1217.09 5.0018

🔻 1216.27

1216.98 0.1489

1216.94 0.08218

1216.92 0.3

1216.85 6.01827

1216.8 0.09138

1216.71 0.3

1216.7 2.06

1216.67 0.08347

1216.66 5.03956

1216.63 3.31

subscribing to private inverse execution reports

Get your API creds from bybit. You can also use their testnet.

Select 5:

🐊 welcome to coingator 🪙. type your option:

➡ 5: sub to private inverse execution topics

This will open a websocket with bybit and subscribe to a private account for the following topics:

- ticket info sequences

- outbound account info sequences

subscribing to private positions

Get your API creds from bybit. You could also use their testnet.

Select 6:

🐊 welcome to coingator 🪙. type your option:

➡ 6: sub to private positions topics

This will open a websocket with bybit and subscribe to private positions on the following topics:

- positions

- executions

- orders

- stop orders

- wallets

resources

- Cointegration-Based Pairs Trading Strategy in the Cryptocurrency Market (arxiv:2109.10662)

- "By considering the main limitations in the market microstructure, our strategy exceeds the naive buy-and-hold approach in the Bitmex exchange. Another significant finding is that we implement a numerous collection of cryptocurrency coins to formulate the model’s spread, which improves the risk-adjusted profitability of the pairs trading strategy. Besides, the strategy’s maximum drawdown level is reasonably low, which makes it useful to be deployed. The results also indicate that a class of coins has better potential arbitrage opportunities than others."

- Constructing Cointegrated Cryptocurrency Portfolios

- As the cryptocurrency market continues to grow with new coins and new exchanges, it’s very important for individual investors, crypto-fund managers, as well as regulators to understand the price dependency among all cryptocurrencies, along with their derivatives.