PyXIRR

Rust-powered collection of financial functions.

PyXIRR stands for "Python XIRR" (for historical reasons), but contains many other financial functions such as IRR, FV, NPV, etc.

Features:

- correct

- blazingly fast

- works with different input data types (iterators, numpy arrays, pandas DataFrames)

- no external dependencies

Installation

pip install pyxirr

Benchmarks

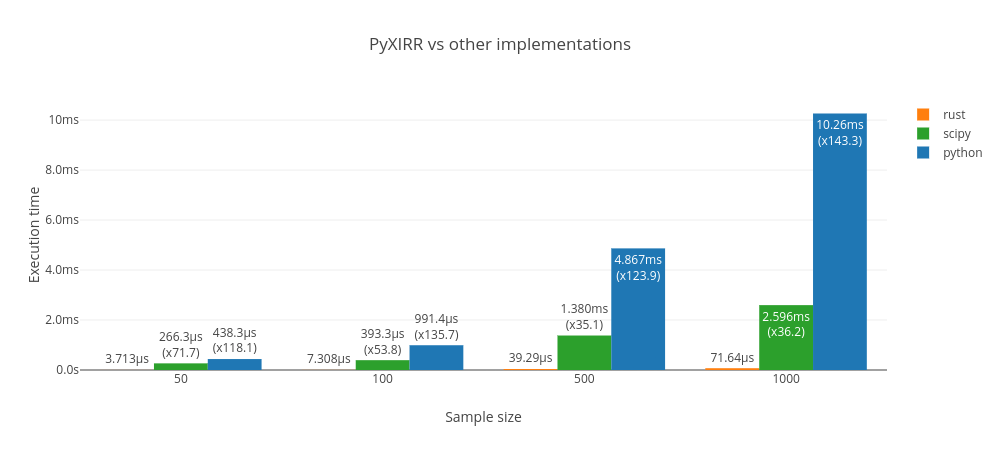

Rust implementation has been tested against existing xirr package (uses scipy.optimize under the hood) and the implementation from the Stack Overflow (pure python).

PyXIRR is ~10-20x faster in XIRR calculation than the other implementations.

Powered by github-action-benchmark and plotly.js.

Live benchmarks are hosted on Github Pages.

Examples

from datetime import date

from pyxirr import xirr

dates = [date(2020, 1, 1), date(2021, 1, 1), date(2022, 1, 1)]

amounts = [-1000, 750, 500]

# feed columnar data

xirr(dates, amounts)

# feed iterators

xirr(iter(dates), (x / 2 for x in amounts))

# feed an iterable of tuples

xirr(zip(dates, amounts))

# feed a dictionary

xirr(dict(zip(dates, amounts)))

# dates as strings

xirr(['2020-01-01', '2021-01-01'], [-1000, 1200])

Numpy and Pandas support

import numpy as np

import pandas as pd

# feed numpy array

xirr(np.array([dates, amounts]))

xirr(np.array(dates), np.array(amounts))

# feed DataFrame (columns names doesn't matter; ordering matters)

xirr(pd.DataFrame({"a": dates, "b": amounts}))

# feed Series with DatetimeIndex

xirr(pd.Series(amounts, index=pd.to_datetime(dates)))

# bonus: apply xirr to a DataFrame with DatetimeIndex:

df = pd.DataFrame(

index=pd.date_range("2021", "2022", freq="MS", closed="left"),

data={

"one": [-100] + [20] * 11,

"two": [-80] + [19] * 11,

},

)

df.apply(xirr) # Series(index=["one", "two"], data=[5.09623547168478, 8.780801977141174])

Other financial functions:

import pyxirr

# Future Value

pyxirr.fv(0.05 / 12, 10 * 12, -100, -100)

# Net Present Value

pyxirr.npv(0, [-40_000, 5_000, 8_000, 12_000, 30_000])

# IRR

pyxirr.irr([-100, 39, 59, 55, 20])

# ... and more! Check out the docs.

API reference

See the docs

Roadmap

- Implement all functions from numpy-financial

- Improve docs, add more tests

- Type hints

- Vectorized versions of numpy-financial functions.

- Compile library for rust/javascript/python

Development

Running tests with pyo3 is a bit tricky. In short, you need to compile your tests without extension-module feature to avoid linking errors. See the following issues for the details: #341, #771.

If you are using pyenv, make sure you have the shared library installed (check for ${PYENV_ROOT}/versions/<version>/lib/libpython3.so file).

$ PYTHON_CONFIGURE_OPTS="--enable-shared" pyenv install <version>

Install dev-requirements

$ pip install -r dev-requirements.txt

Building

$ maturin develop

Testing

$ LD_LIBRARY_PATH=${PYENV_ROOT}/versions/3.8.6/lib cargo test --no-default-features --features tests

Benchmarks

$ pip install -r bench-requirements.txt

$ LD_LIBRARY_PATH=${PYENV_ROOT}/versions/3.8.6/lib cargo +nightly bench --no-default-features --features tests

Building and distribution

This library uses maturin to build and distribute python wheels.

$ docker run --rm -v $(pwd):/io konstin2/maturin build --release --manylinux 2010 --strip

$ maturin upload target/wheels/pyxirr-${version}*